Next

Web

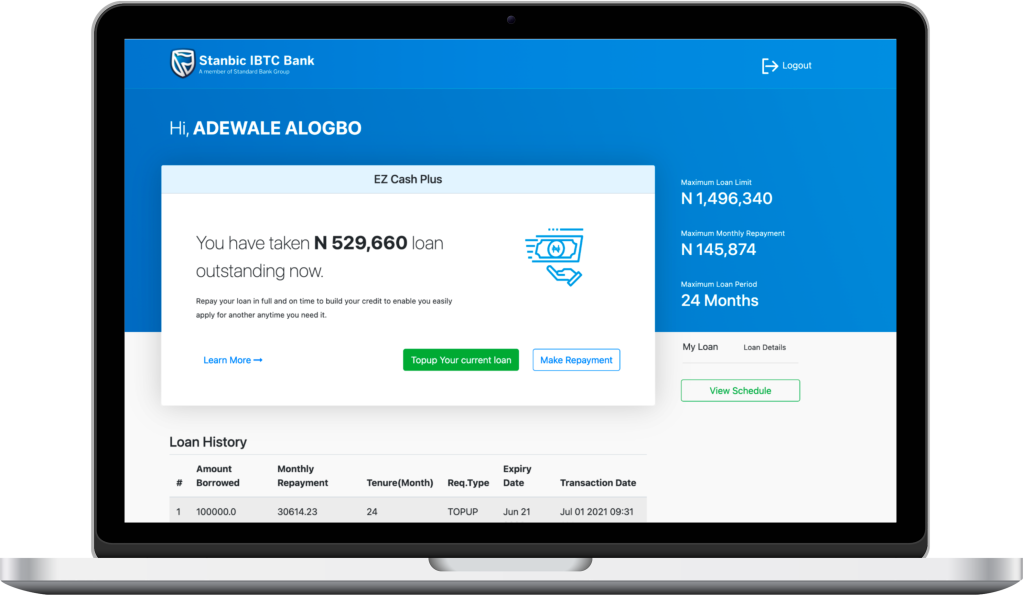

EZ Cash

Case Study

Unsecured Loan

THE IDEA

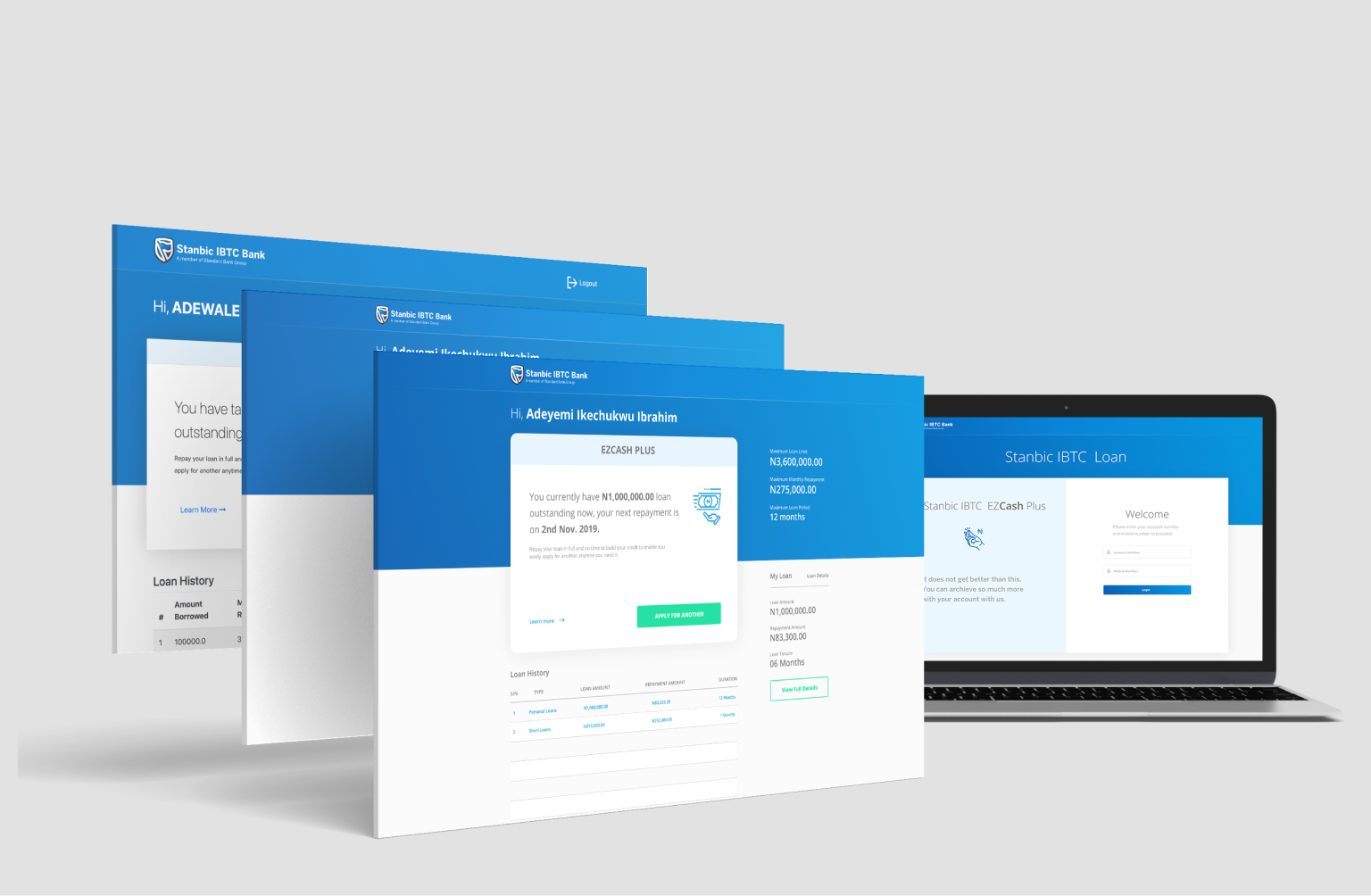

EZ Cash Loan is a loan product offered by Stanbic IBTC that is designed to provide short-term financing to eligible individuals or businesses for various purposes, such as personal needs, education, or business investment.

THE PROBLEM

This product was built to solve the problem of reducing the time spent at the bank to apply for an unsecured loan. Previously, when the customer applies for a loan, it took about 2 weeks for the funds to be credited into the customers account but with this product it occurred in minutes.

The product is made accessible to customers of the web, once they reach the landing page requesting for their bank account number and mobile number linked to their bank account.

AUDIENCE

For a customer to be credited it is required that they meet some criteria. Criteria such as

- Owning an account with the bank.

- Such account must have been active for about 6 months.

- The account must be have been funded regularly (i.e it could be a salary account).

- The bank must have adequate information about the customer.

- The credit worthiness / history of the customer must be positive at the time of application of the loan.

THE PRODUCT

The product is a term loan that offers eligible active account holders, instant access to funds ranging from N20,000 up to N4,000,000 for a period of 24month, anytime, anywhere with no documentation required.

Design Process

The design process used for this problem was the “Design Thinking” approach. It involved empathizing with users, defining the problem, ideating, prototyping, and iterating through multiple cycles to achieve a final solution. It fostered a collaborative and iterative mindset, prioritizing user needs and feedback for continuous improvement.

- Customer Interviews

- Empathy Map

- User Personas

- User Journey Map

- Problem Statement

- Brainstorming

- User Task Flow

- Sketching

- Mid Fidelity Wireframes

- High Fidelity Wireframes

- Usability Testing

Empathise

Introduction

During the empathizing stage of the design process for the EZ cash product, it was sought to deeply understand the needs, preferences, and pain points of the banks customers. I engaged in activities such as conducting customer interviews, observing their behavior, and gathering feedback through stakeholder engagements. I actively listened to users, placing myself in their shoes to gain insights into their financial behaviors, challenges, and motivations.

By empathizing with the customers, I aimed to uncover key insights that would inform the design decisions of the EZ cash product, ensuring it would effectively address the real needs and desires of the banks customers. This stage laid the foundation for the approach that guided the entire design process, it ensured that the final product was tailored to meet the specific requirements of the target users.

Customer Interviews

By talking to the banks customer who mostly complained about a couple of challenges they experienced while trying to apply for the loan facility with the bank. Amongst the pain points listed below were experienced by the customers:

Customer pain points:

- Lengthy form filling

- Long delay in application process

- Bank branch visit

- Queuing up to begin process

- Would you be more likely to use an app that allows you to make bookings or reservations directly through the app?

Hearing these frustrations from customers, revealed opportunities and insights to solving this problem.

Loan Application Form

Empathy Map

This empathy map aims to address the bank’s users need for clarity, simplicity, and reliability in the loan process, ensuring transparency in communication and providing a user-friendly experience that fosters confidence in choosing the right loan product.

Persona

Persona will give us a clear concept of a users needs and frustrations.

Sarah Adeboyega

“Creativity is intelligence having fun.”

About

Sarah, a 35-year-old marketing executive, blends creativity with strategic prowess in crafting impactful campaigns. Her wealth of experience and deep insight into consumer behavior drive her innovative approach to navigating the fast-paced marketing landscape. Beyond her career, Sarah’s passion for creative pursuits enriches her strategies, making her a valuable asset in the dynamic realm of marketing.

| Age | 32 |

| Occupation | Marketing Executive |

| Revenue | NGN 5.4m p.a. |

| Status | Single |

| Location | Lagos, Nigeria |

Needs / Goals

- Easy and affordable access to financial services to manage his business transactions.

- Simple and user-friendly solution for transferring money to suppliers or other business partners.

- Reliable and secure financial services that can be accessed even in remote areas.

- Responsive customer support that can provide assistance in his local language.

Behaviors and Habits

- She has prudent financial habits. She meticulously manages her expenses, maintains a budget, and prioritizes timely bill payments. She values financial stability and is cautious about taking on debt.

- Sarah prefers convenient and hassle-free processes. She appreciates online platforms and digital tools that streamline loan applications, offer transparency, and provide easy access to account management.

Attitudes and Emotions

- Values simplicity and affordability in financial services due to his limited financial resources.

- May be cautious about using digital financial services due to limited familiarity or concerns about security.

- Expects reliable and accessible customer support that can understand and address his local language or cultural nuances.

- May feel relieved and satisfied with a convenient and affordable solution for managing his business finances.

Ibrahim Onochie

“Efficiency isn’t about doing more in less time; it’s about doing more of what truly matters”

About

Ibrahim Onochie a 32-year-old civil engineer from Kubwa, Abuja, specializes in sustainable infrastructure solutions. Meticulous and tech-savvy, he values efficiency, preferring modern approaches over traditional methods. Financially conscious and detail-oriented, Alex seeks convenience and transparency in financial services while balancing innovation with pragmatism in both work and life.

| Age | 39 |

| Occupation | Engineer specializing in Civil Engineering |

| Revenue | NGN 27.8m p.a. |

| Status | Single |

| Location | Kubwa, Abuja |

Needs / Goals

- He occasionally needs additional funds for professional development courses, networking events, or unexpected expenses related to her job.

- He is looking for a hassle-free and quick solution when it comes to managing his finances, including accessing loans for personal or professional needs.

- Having a reputable and trustworthy financial institution offering the loan product is crucial for Alex. He values reliability and a solid track record in the financial services industry.

Behaviors and Habits

- He tends to approach problems analytically. He breaks down tasks, decisions, and challenges into smaller, manageable parts to find the most effective solutions.

- He is naturally inclined toward innovative problem-solving. He approaches challenges creatively, often thinking outside the box to find unconventional yet effective solutions.

- As an engineer, He prioritizes structure, dedicating specific time slots for work, personal projects, and relaxation, allowing him to efficiently manage his time.

Attitudes and Emotions

- He feels frustrated by the traditional loan application process, finding it time-consuming and disruptive to his structured routine.

- He experiences discomfort with the extensive paperwork involved in the traditional loan applications, considering it cumbersome and outdated.

- He prefers digital platforms or online applications that align better with his fast-paced lifestyle and allow for more efficient management of the loan application process.

User Journey Map

This is used to visualise the steps a user goes through to accomplish a specific goal with a product or service. It's used primarily to understand and improve the user's experience.

Define

The Defining stage of the design process for the EZ Cash product involved analyzing user research findings, identifying key insights, and establishing design goals and objectives to address user needs and challenges. This stage aimed to clearly define the problem statement for the product to be designed.

Problem Statement

The problem statement for the EZ Cash product was to:

This helped to narrow down the focus and scope of the product, identify the target user segment, and establish design goals and objectives. This stage laid the foundation for the subsequent stages of the design process.

“Provide a solution that enables the existing bank customers to access loan facility, in a convenient, secure, and user-friendly manner, overcoming the challenges and limitations they face in traditional banking methods.”

Ideation

The ideation stage of the design process involved a creative and collaborative brainstorming process to generate a wide range of potential ideas and concepts for the product. By having stakeholders engagement with various units involved in the loan process application process. We were able to explore different possibilities, challenged assumptions, and encouraged diverse perspectives to generate innovative and feasible ideas.

These ideas were then evaluated based on their alignment with the defined problem statement, feasibility, and potential impact on the target users. The ideation stage fostered a culture of experimentation, creativity, and collaboration, allowing the generation of a rich pool of ideas that would inform the subsequent stages of the design process, such as prototyping and testing, to refine and validate the best solutions for the EZ Cash product.

Brainstorming Sessions

Brainstorming sessions were held with different unit of the bank involved in the loan application process to discover more insights and discover potential solutions to the pain points and challenges the bank customer were facing in acquiring loan facilities.

The brainstorming process during the ideation stage for the EZ Cash product was a collaborative approach that encouraged open and free-flowing idea generation, utilizing techniques such as mind mapping to stimulate creativity and generate a diverse pool of potential solutions.

Brainstorming Outcome

User Task Flow

User flow will show every interaction of users from start to reaching their goal.

The flow displayed below shows the interaction for onboarding, Place Search, and Making a Review.

MVP 1

MVP 1

Prototype

The prototyping stage for the EZ Cash product involved creating tangible and interactive prototypes, such as paper and digital mock-ups, to gather feedback and iterate on design concepts. These prototypes were invaluable in validating the design and ensuring a user-centered approach to development.

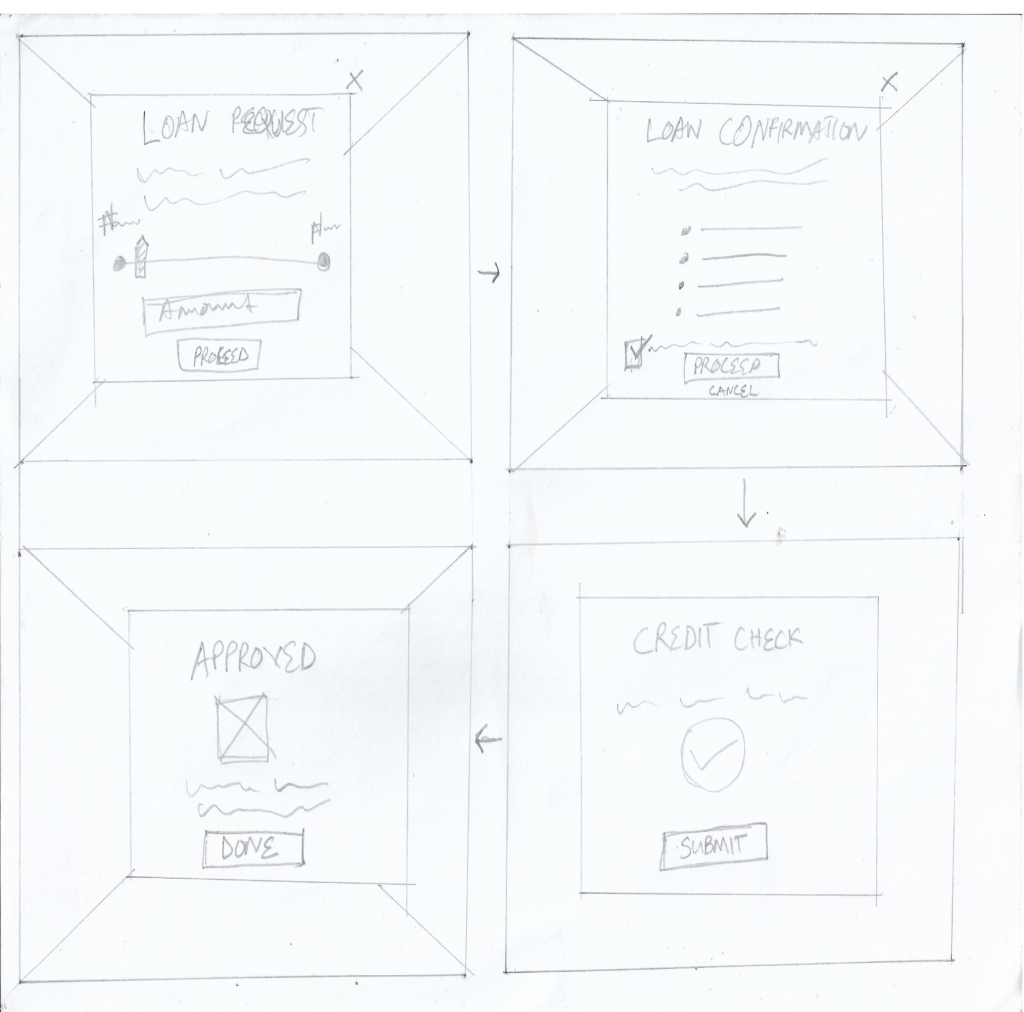

Wireframe / Sketches

I sketched out the first iteration of the EZ Cash product using the first user task flow. The sketches brought my ideas to life. By sketching and trying out different ideas I was able to iterate before deciding one the best route to go.

Design decisions were made based on research insights and learnings from customer interviews and stakeholder engagement sessions.

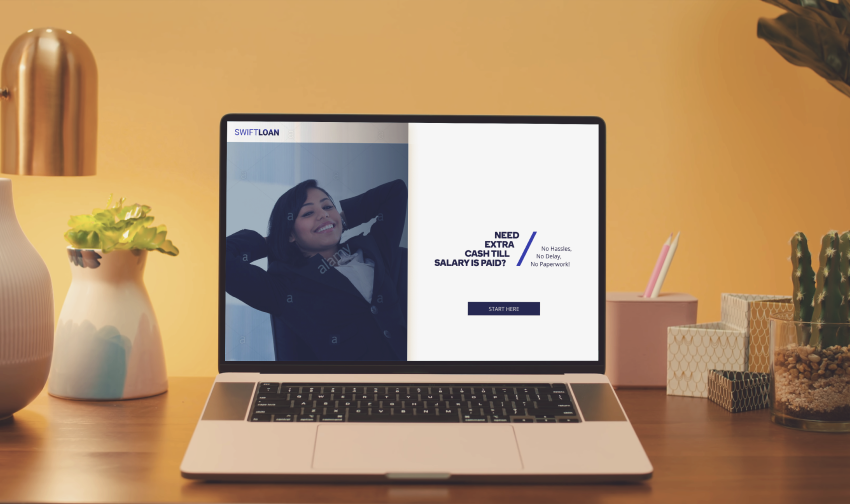

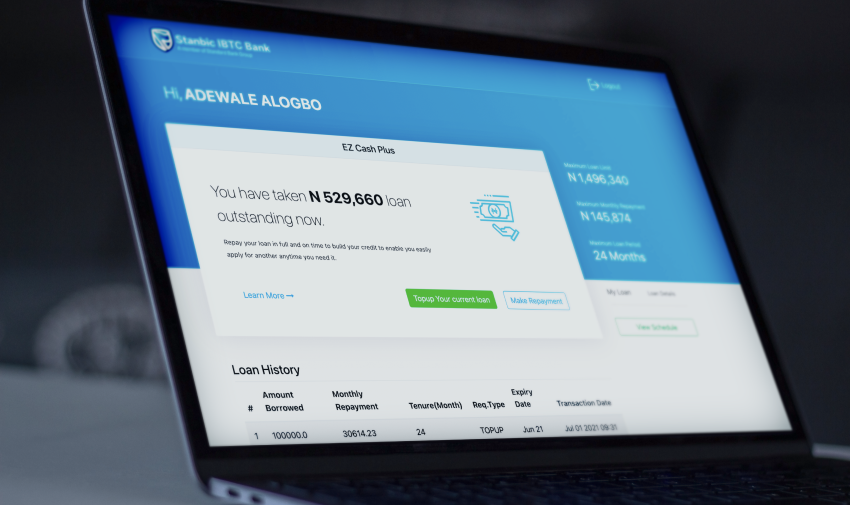

High Fidelity UI

MVP 1

MVP 2

The product is a flagship product of the Bank. I came up with the UX Design for the web version of the product to which the loans successfully disbursed amounted to 12.8billion NGN the first year. The web channel disbursed 37.17%, the mobile app channel did 9.99%, the internet banking channel did 14.08% and the USSD did 38.75%.

Usage

NGN 12.8 Bn Disbursed

Year 1

Available channels

38.75%

Year 1

USSD (Dial: *909#)

14.08%

Year 1

Internet

Banking

9.99%

Year 1

Mobile App