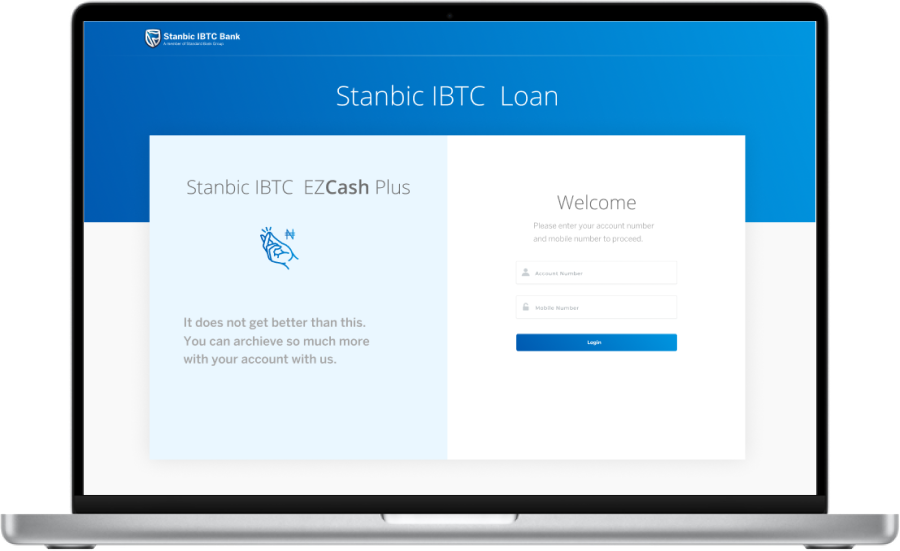

Stanbic IBTC's

EZCash

Making access to unsecured loans fast, easy and convenient.

This product was built to solve the problem of reducing the time spent and frustrating process of form filling at the bank to apply for an unsecured loan.

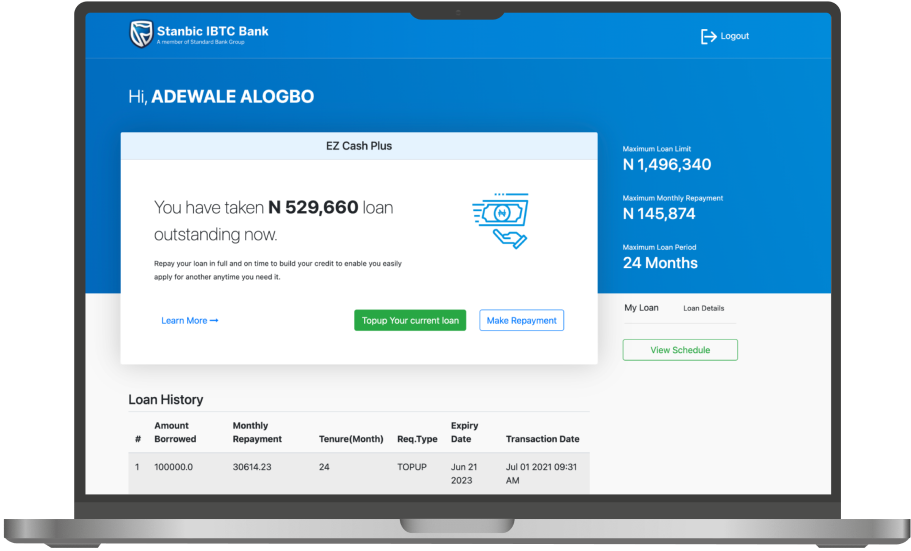

Previously, when the customer applies for the loan, it took about 2 weeks for the funds to be credited into the customers account but with this product it occurred in minutes.

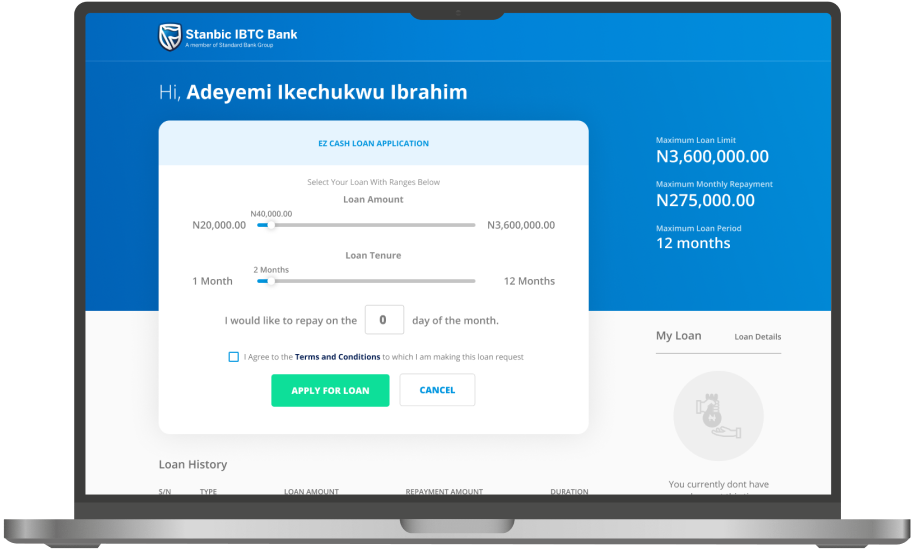

I was tasked with re-imagining the loan application experience to increase transaction velocity of the banks loan books and also optimised the process internally. The challenge resulted in the reduction of steps and ease of use for the customer to receive funds into their bank accounts.

MY ROLE

- Product Design

- User Research

- Wireframing

- Rapid Prototyping

- User Interface Design

- Front end Development

Tools Used

Its done in less than 6mins.

In designing this product, it was required that I talk to customers to understand their pain points when they came to the bank branch to apply for an unsecured loan. Further engagement was made with the various teams within the bank to get an understanding of the process. By doing this, insights were revealed on where the challenges and innovation opportunities lay.

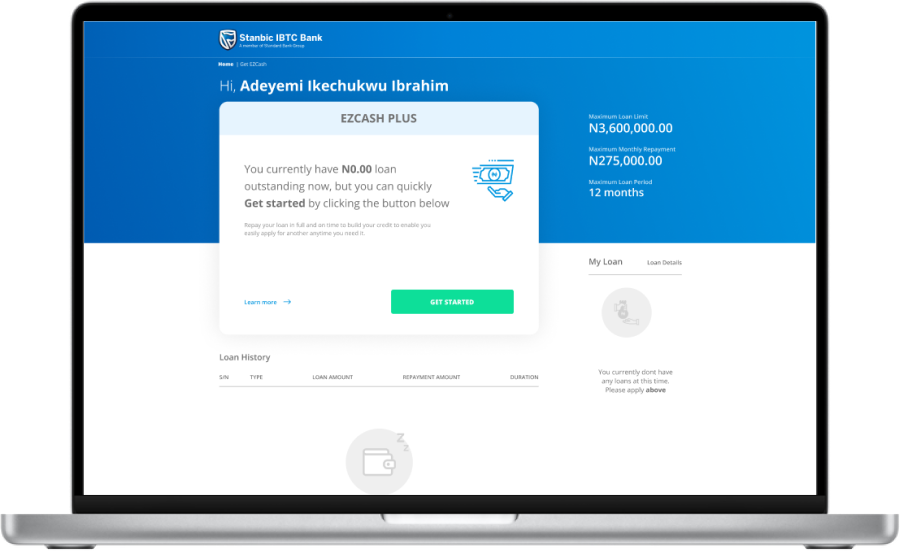

By limiting the number of information collected from customer and their data with the bank, together with partnership with credit bureau institutions, the product was brought to life.

Fast and Easy loans to cater to immediate needs

EZ Cash Loan is a loan product offered by Stanbic IBTC that is designed to provide short-term financing to eligible individuals or businesses for various purposes, such as personal needs, education, or business investment.

With an interest rate of 2.5% monthly to pay back within 24months.

The product is a flagship product of the Bank. I came up with the UX Design for the web version of the product to which the loans successfully disbursed amounted to 12.8billion NGN the first year. The web channel disbursed 37.17%, the mobile app channel did 9.99%, the internet banking channel did 14.08% and the USSD did 38.75%.