Designing targeted savings with a bank - agnostic approach.

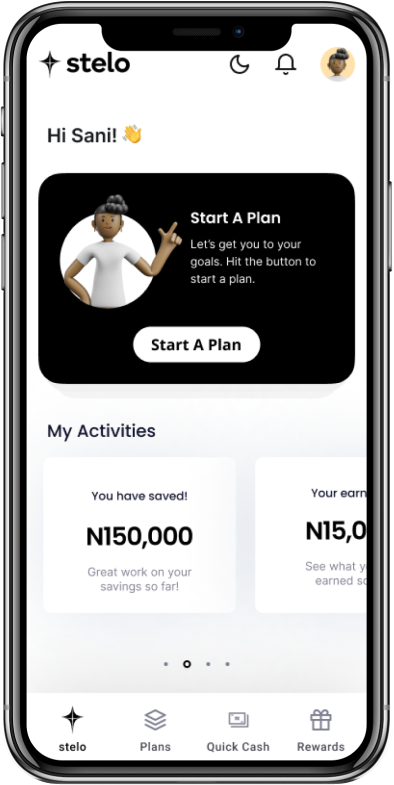

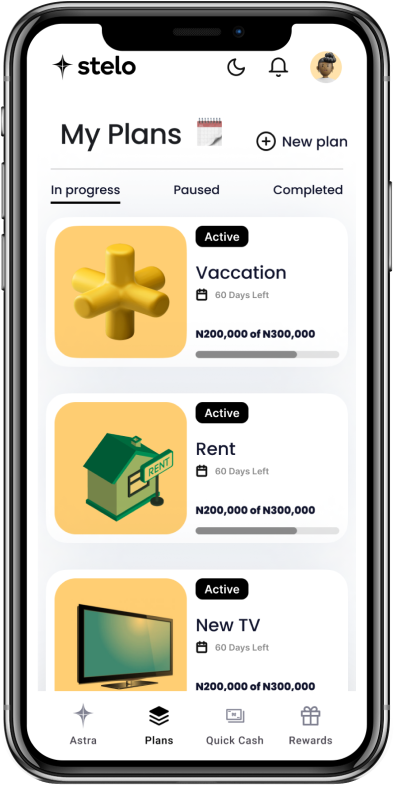

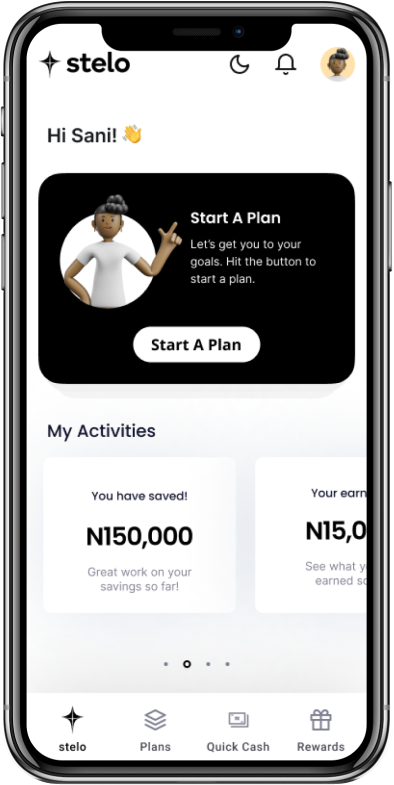

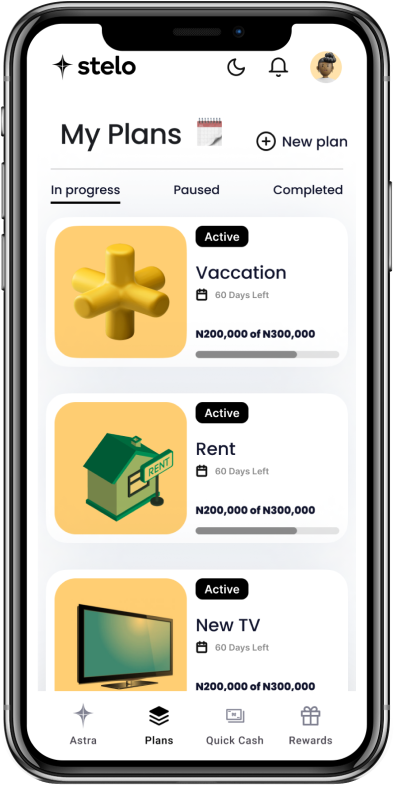

Stelo introduces an innovative and bank-agnostic targeted savings solution, empowering users to craft personalized savings plans for various life needs and special occasions like rent payments, vacations, birthdays, and anniversaries.

As the designer behind this transformative experience, my mission was to enable the way individuals save, fostering increased engagement and financial wellness. The result? A simple, easy, user-friendly, and unforgettable interface that effortlessly guides users through their savings journey.

Additionally, I designed a web and mobile version of this product to introduce both new and existing members to the Stelo product and its myriad benefits.

MY ROLE

- Product Design

- Interaction Design

- User Research

- Wireframing

- Rapid Prototyping

Tools Used

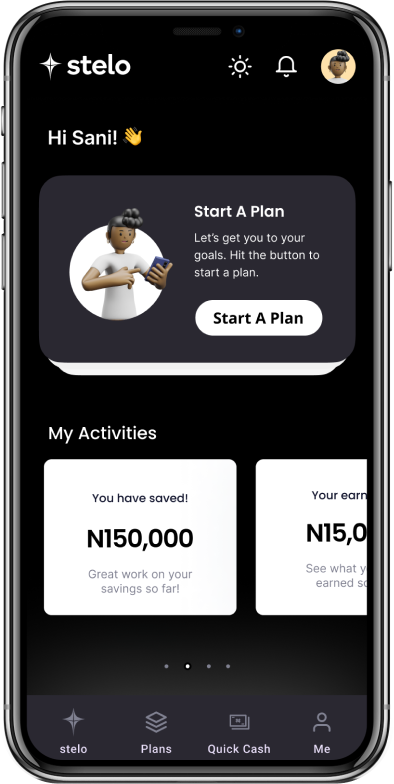

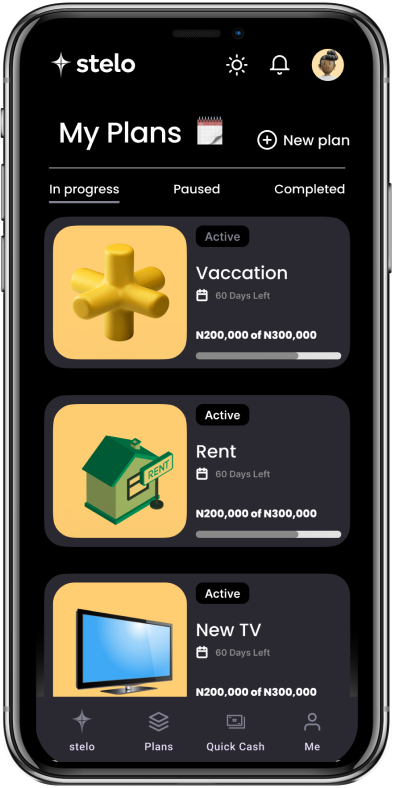

Enhancing Your Savings App Experience with Light and Dark Modes

Implementing dark mode in the savings-targeted app for a youthful demographic enhances user experience. It aligns with aesthetic preferences, reduces eye strain, and adapts to dynamic lighting conditions, offering a visually appealing and adaptable tool for financial planning, ultimately promoting engagement and a positive user-finance relationship.

Oh yes, its extended accessibility to a broader audience as well.

Get prompt and notifications all set by you.

Usage

3-5 Active Subscriptions

Management Behavior

40%

Rarely, forgetting to cancel or pause subscriptions.

45%

15%

Usability Testing

80%

- Request for pause/cancellation feature.

- Easy of use

- Positive comments on the look and feel

Consumers need to be empowered to manage subscriptions

48%

Check deadlines from time to time but have no centralised overview

Source: Visa Market Research, Q4 2021.

42%

of consumers had problems with the administration of their subscriptions at some point

87%

of consumers have no centralised system to manage subscriptions.